Keystart App

Developing innovative fintech for Keystart

Empowering Homeownership

equ has partnered with Keystart for several years, initially developing its website to simplify the complex home loan enquiry and customer onboarding process. Although successful in facilitating initial home loan enquires, it raised the question of how to assist customers in accumulating home equity and transitioning to traditional lenders—a key part of Keystart's mission as a transitional lender. To address this, equ and Keystart co-developed a market-leading finance app, enabling customers to track their equity position and transition their home loan sooner.

Iterative design and comprehensive user validation

The hypothesis appeared logical: using fintech to aid users in tracking home equity. However, given the project's magnitude, it was essential to confirm this with customer validation.

The research provided us with a comprehensive understanding of the audience's financial literacy levels, their experiences in the home ownership journey, as well as the tools, features, and techniques that strongly resonated with them.

Utilising an iterative design process from sketches to design, we refined our ideas based on customer validation, ensuring the finance app effectively addressed users' needs. The result was a finely crafted tool tailored to guide users through building their understanding and tracking of equity and ultimately preparing them for transitioning to traditional lenders

A design language that resonates

Keystart audiences typically consist of first homebuyers and customers with differing levels of financial literacy. It was evident that using traditional financial language and themes would not effectively resonate with them.

Furthermore, the process of building equity in a home can be an uncertain and long-term journey, often filled with obstacles along the way.

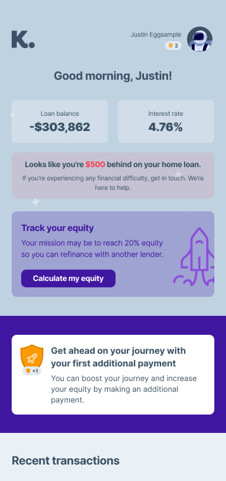

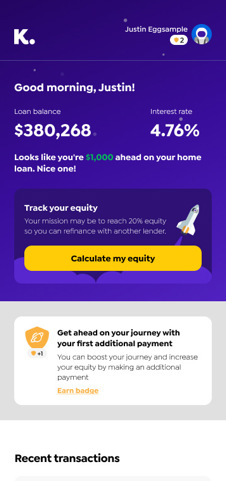

With these considerations in mind, our design team developed a distinctive 'space' theme: Your mission - planet 20% equity. Your mission control - Keystart’s customer service team.

To validate the space creative theme and assess the app's usability, we created interactive prototypes that we iteratively tested on end users.

We have liftoff! When launching the app for the first time, users complete the registration, after which their rocket ship launches into space - an analogy used during the onboarding process to introduce them to financial terminology and app features.

This is Alex speaking, from Keystart Mission Control

The app features an assistant named Alex, hailing from Keystart Mission Control. Alex plays a pivotal role in enhancing user experience by facilitating understanding of the app's features. They guide users through various tools, offering assistance and insights to optimise interaction with the platform. Alex goes beyond simple guidance, providing users with valuable tips and tricks to effectively manage their home loan, ensuring a seamless and informed experience for all users.

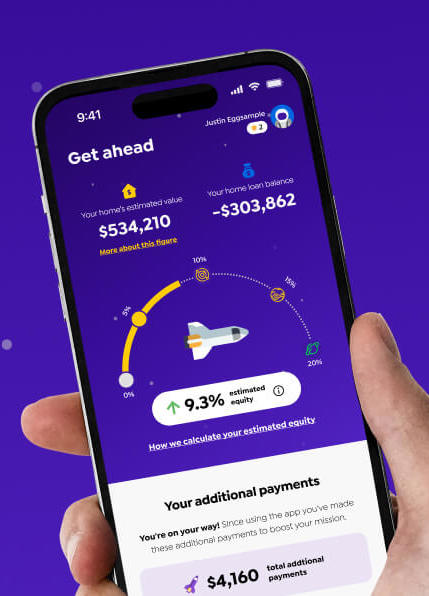

Tracking home loan progress. The app introduces an innovative tool that allows users to monitor their equity percentage. This tool not only educates users about equity but also provides real-time estimates using market data. By completing the equity estimator, users can continuously track their position, aiming to reach a 20% equity milestone that enables refinancing to another lender.

Getting ahead. A "Get ahead" section allows users to make scheduled extra payments or one-time lump-sum repayments at their convenience. The app also provides a tracking feature to monitor and visualise the cumulative effect of these additional repayments, empowering users to pay off their loans sooner and save on interest costs.

Gamifying life with a home loan. The system features a gamification element with badges that customers earn as they progress through various financial milestones. These badges are awarded when customers complete the onboarding process, utilise the equity estimator tool, make additional repayments, and achieve specific milestones including several related to building equity.

Considering the time required to build equity in a home, gamification is an effective strategy to infuse enjoyment, reward, and engagement into the customer's home loan journey.

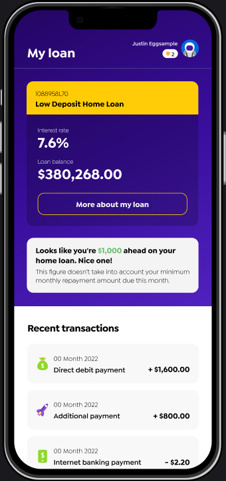

Simplified loan management

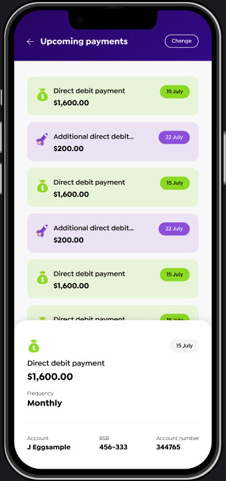

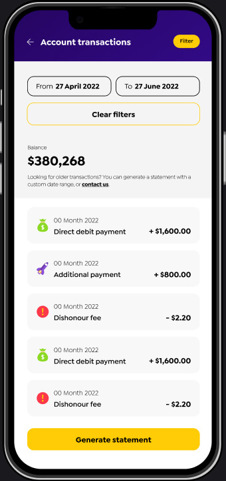

The app provides users with self service loan management capabilities. Users can access transaction history and financial statements for a clear overview of their account activity.

A collaborative partnership

Due to app's technical complexity and the substantial integrations with Keystart's internal systems and custom-built API, the establishment of a collaborative partnership between our team and Keystart was essential. To achieve this, we operated in an agile framework in which both teams operated on a shared fortnightly sprint cadence with shared ceremonies to maintain alignment.

The app's success relied on a collaborative partnership with Keystart through agile methodologies like shared sprints and ceremonies for alignment.

A Dynamic App Ecosystem

The app was developed using a diverse array of technologies, combining React Native for the iOS and Android applications with a .NET GraphQL middleware API layer. Integration was established through Microsoft Azure cloud infrastructure. Firebase was used for push notifications, while seamless content integration was achieved through connections with CMS platform Sitefinity to pull in articles and other relevant content.

To ensure data security and user privacy, row-level security measures were implemented at the database level, preventing unauthorised access to sensitive information.

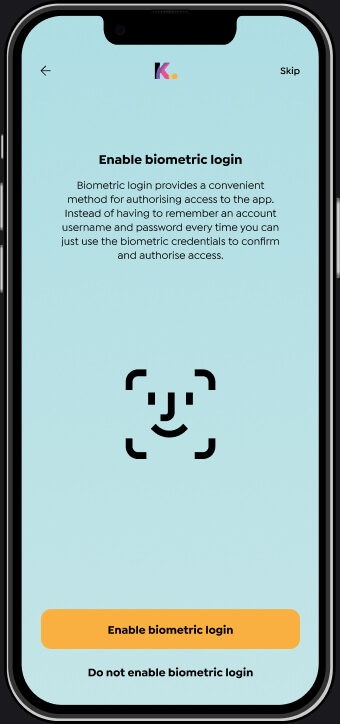

Banking level security. Given the critical and sensitive nature of customer financial information, it was imperative that the app integrated highly robust security measures to protect and prevent any unauthorised access to customer data. The app also offers the option to set up a PIN, and biometric login for the customer’s convenience while still maintaining a high security posture.

In close partnership with our team, equ brought a mix of innovation, strategic insight, and technical know-how to the table. They conceived an engaging design concept, allowing us to create not just an app, but a compelling experience that allows our customers to track their home ownership goals. We are thrilled with the result, and the response from customers has been exceptional.

Next case study